Poverty is about not having enough money to meet basic needs including food, clothing, and Shelter. However, it is much more grave than it seems to be. In Fact, it is a trap that needs a lot of courage and proper planning to break. When talked about in terms of Economics, a poverty trap is caused by self -intensifying mechanisms that cause poverty. It can persist across generations.

As Aristotle quotes,” the mother of Revolution and Crime is poverty”. Indeed this statement seems to become more emphasized in the 21st century. The poverty cycle creates dearth in fulfilling basic necessities and therefore it becomes more difficult for an individual to think about their wants. The have- nots section of the society cannot think beyond their needs and consequently gets more involved in getting things done in the wrong ways. Hence generating social evils.

The World Bank Organization describes poverty in this way:

“Poverty is hunger. Poverty is a lack of shelter. Poverty is being sick and not being able to see a doctor. Poverty is not having access to school and not knowing how to read. Poverty is not having a job, is fear for the future, living one day at a time………….”

Nevertheless, building wealth and overcoming poverty seems to be a challenge -but it is possible. Here are some tips which you can follow and can get a tight hold on to the remote of your life!!

Table of Contents

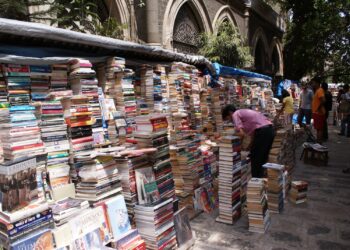

1# Educate yourself

This aspect comes first because of its importance. The basic truth is that the less you know, the more susceptible you are to fall into various traps. We all know that most schools don’t provide education in terms of handling your finances well. So it is the call of the hour to self educate. After all, Education opens all doors.

If you are a fresher, consider the following points just to be sure enough:

. How credit works

. Fundamental financial literacy

. Options in terms of financial products and Institutions.

. Your rights in terms of Banking

Note- Saving where you can is particularly important for people with low income

For basic financial literacy read our blog and consult other sources. To know your rights, you can visit the Consumer Financial Protection Bureau(CFPB). This company makes sure you are treated fairly when dealing with Banks and Lenders. They also run the program for financial Coaching.

2# Change Your Mindset Towards Money

When it comes to improving your personal finances and achieving financial wellness, it’s 20% skill, and 80% behavior and mindset,” Bola Sokuunbi from Clever Girl Finance says.

For many low- income generators, the most difficult part of breaking the cycle of poverty is changing their perspective towards money. Their parent’s way of handling finances is deeply ingrained and hence may affect their monetary decision. To change your money mindset you can ponder upon the following points:

. The way you were raised with money!

. What triggers you to spend more!

. Your current money beliefs!

. The money you own outright!

. Small Steps which you can take to change existing beliefs

Sharita M. Humphrey, a financial educator, adds to this and says, you’re not poor, you’re just in a lower wealth status. Thus, clearly offering another mindset shift to boost the confidence.

3# Don’t Rely on Payday loans

If you just go by the name, you can clearly make it out that a payday loan is just for one day. But the truth is beyond this because if you get caught in the cycle of payday lending, you could be paying for that loan for years to come. There are few measures which you can take to avoid taking such types of loans:

- . Try to start an emergency fund.

The best and most convenient thing which you can do to avoid payday lenders is to stick to your budget. In a more elaborated way, you can take into account your income and expenditure beforehand to tackle any emergency situations. If you stick to your budget then you don’t immediately turn to lenders for help.

4# Leverage Community Resources

While changing your money mindset is helpful, looking up ways to tackle finances can take you so far.

As comedian Trevor Noah says in his book Born a Crime:

“People love to say,” Give a man a fish, and he’ll eat for a day. Teach a man to fish, and he’ll eat for a lifetime.’ What they don’t say is, ‘And it would be nice if you gave them a fishing rod.”

Finding tools and helping hands makes you more powerful. Don’t struggle in isolation and take advantage of the resources available in your local community. You can look upon the options of Online as well as face-to-face interaction. Following are the alternatives

- Public Libraries or schools.

- Community centers.

- Non-profit organizations

5# Ask Someone You Trust

Though it is not good to discuss your money and finances with everyone. However, you can always ask for someone’s help whom you trust.It can be a family member or a close friend whom you trust.

And if you don’t know someone personally you can go for options available online. There are numerous online sites that can provide you financial counseling and guidance.

The key point is, you are not supposed to go through this process alone. There are a number of authentic platforms where you can get the best financial advice. A little bit of research is all you need to do!

6# Don’t Feel Shy To Walk Away

If a bank or lender tries to befool you by hiding stuff, or not being honest, walk away. Trust your intuition in money matters as well.

You can get a vast number of options, so be sure to hunt for a financial institution that will protect your right to be treated well!!

Also, Read:

A Story Of Politics, Religion, Power, And Controversies